Software Costs Frs 102 . Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for migration and testing. Web under old gaap, website development costs were classed as property, plant and equipment whereas under frs 102. Web this chapter gives a comparison of frs 102 section 18 and ifrs, and covers recognition and initial measurement,. Under frs 102 website development costs are usually considered in the context of intangible assets. Web under frs 10, software costs which met the definition criteria of an asset were capitalised exclusively as a tangible rather than. Web under frs 102, if software classifies as a tangible fixed asset, it would normally obtain tax relief through the capital allowances. Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap.

from www.slideshare.net

Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for migration and testing. Web under frs 10, software costs which met the definition criteria of an asset were capitalised exclusively as a tangible rather than. Web under old gaap, website development costs were classed as property, plant and equipment whereas under frs 102. Web this chapter gives a comparison of frs 102 section 18 and ifrs, and covers recognition and initial measurement,. Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap. Under frs 102 website development costs are usually considered in the context of intangible assets. Web under frs 102, if software classifies as a tangible fixed asset, it would normally obtain tax relief through the capital allowances.

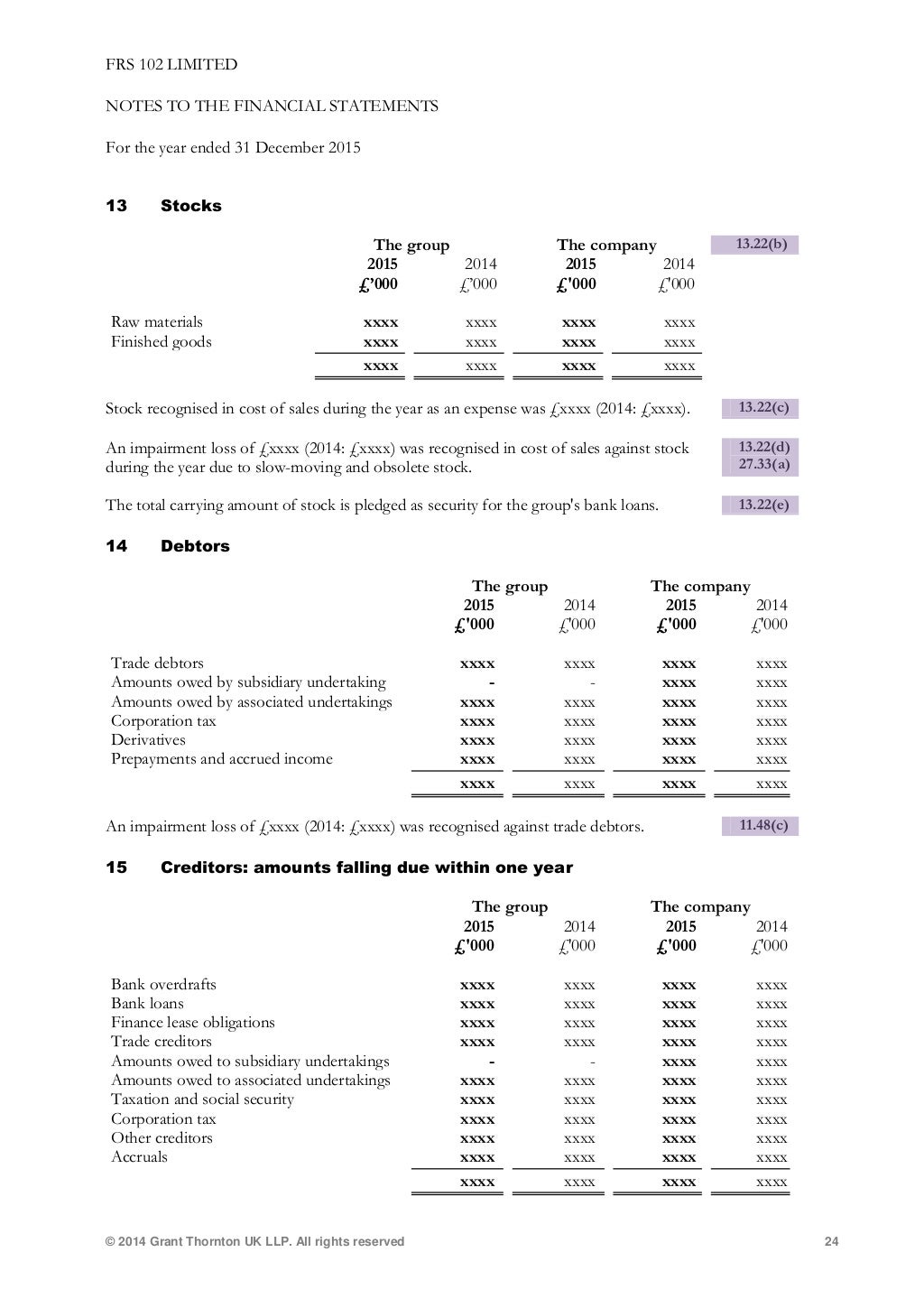

FRS102LimitedExampleFinancialStatements

Software Costs Frs 102 Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap. Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for migration and testing. Web under frs 102, if software classifies as a tangible fixed asset, it would normally obtain tax relief through the capital allowances. Web this chapter gives a comparison of frs 102 section 18 and ifrs, and covers recognition and initial measurement,. Web under frs 10, software costs which met the definition criteria of an asset were capitalised exclusively as a tangible rather than. Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap. Web under old gaap, website development costs were classed as property, plant and equipment whereas under frs 102. Under frs 102 website development costs are usually considered in the context of intangible assets.

From www.slideshare.net

FRS102LimitedExampleFinancialStatements Software Costs Frs 102 Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap. Under frs 102 website development costs are usually considered in the context of intangible assets. Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for migration and testing. Web under frs 10,. Software Costs Frs 102.

From www.slideshare.net

FRS102LimitedExampleFinancialStatements Software Costs Frs 102 Web under old gaap, website development costs were classed as property, plant and equipment whereas under frs 102. Web this chapter gives a comparison of frs 102 section 18 and ifrs, and covers recognition and initial measurement,. Web under frs 10, software costs which met the definition criteria of an asset were capitalised exclusively as a tangible rather than. Under. Software Costs Frs 102.

From www.slideshare.net

FRS102LimitedExampleFinancialStatements Software Costs Frs 102 Web under frs 102, if software classifies as a tangible fixed asset, it would normally obtain tax relief through the capital allowances. Web this chapter gives a comparison of frs 102 section 18 and ifrs, and covers recognition and initial measurement,. Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap.. Software Costs Frs 102.

From studylib.net

FRS 102 guide Accountancy Magazine Software Costs Frs 102 Web under frs 102, if software classifies as a tangible fixed asset, it would normally obtain tax relief through the capital allowances. Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for migration and testing. Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs. Software Costs Frs 102.

From www.slideshare.net

FRS102LimitedExampleFinancialStatements Software Costs Frs 102 Web under frs 102, if software classifies as a tangible fixed asset, it would normally obtain tax relief through the capital allowances. Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for migration and testing. Web this chapter gives a comparison of frs 102 section 18 and ifrs, and covers recognition. Software Costs Frs 102.

From www.cooneycarey.ie

What is the difference between FRS 102 and FRS 102 S1A CooneyCarey Software Costs Frs 102 Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap. Web this chapter gives a comparison of frs 102 section 18 and ifrs, and covers recognition and initial measurement,. Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for migration and testing.. Software Costs Frs 102.

From www.accountingweb.co.uk

FRS 102 cashflow statements Get the details right AccountingWEB Software Costs Frs 102 Web under old gaap, website development costs were classed as property, plant and equipment whereas under frs 102. Web this chapter gives a comparison of frs 102 section 18 and ifrs, and covers recognition and initial measurement,. Under frs 102 website development costs are usually considered in the context of intangible assets. Web apart from software and hardware costs, the. Software Costs Frs 102.

From www.accountingweb.co.uk

TaxCalc adds FRS 102 to accounts production tools AccountingWEB Software Costs Frs 102 Under frs 102 website development costs are usually considered in the context of intangible assets. Web under old gaap, website development costs were classed as property, plant and equipment whereas under frs 102. Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for migration and testing. Web this chapter gives a. Software Costs Frs 102.

From www.accountingweb.co.uk

FRS 102 Related party transactions for small companies AccountingWEB Software Costs Frs 102 Under frs 102 website development costs are usually considered in the context of intangible assets. Web under frs 102, if software classifies as a tangible fixed asset, it would normally obtain tax relief through the capital allowances. Web under old gaap, website development costs were classed as property, plant and equipment whereas under frs 102. Web apart from software and. Software Costs Frs 102.

From kpmg.com

FRS 102 Your essential guide Accounting Advisory KPMG Ireland Software Costs Frs 102 Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap. Web under frs 102, if software classifies as a tangible fixed asset, it would normally obtain tax relief through the capital allowances. Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for. Software Costs Frs 102.

From studylib.net

Preparing for FRS 102 Illustrative financial statements Software Costs Frs 102 Under frs 102 website development costs are usually considered in the context of intangible assets. Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap. Web under frs 10, software costs which met the definition criteria of an asset were capitalised exclusively as a tangible rather than. Web under old gaap,. Software Costs Frs 102.

From www.accountingcpd.net

FRS 102 Impact on Systems and Data Software Costs Frs 102 Web under frs 10, software costs which met the definition criteria of an asset were capitalised exclusively as a tangible rather than. Under frs 102 website development costs are usually considered in the context of intangible assets. Web under old gaap, website development costs were classed as property, plant and equipment whereas under frs 102. Web this chapter gives a. Software Costs Frs 102.

From studylib.net

FRS 102 time to transition? Software Costs Frs 102 Web under old gaap, website development costs were classed as property, plant and equipment whereas under frs 102. Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap. Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for migration and testing. Web. Software Costs Frs 102.

From www.slideshare.net

FRS102LimitedExampleFinancialStatements Software Costs Frs 102 Web this chapter gives a comparison of frs 102 section 18 and ifrs, and covers recognition and initial measurement,. Web under frs 102, if software classifies as a tangible fixed asset, it would normally obtain tax relief through the capital allowances. Under frs 102 website development costs are usually considered in the context of intangible assets. Web under frs 10,. Software Costs Frs 102.

From userdocs.wolterskluwer.co.uk

FRS 102 ROI S1A CCH Software User Documentation Software Costs Frs 102 Web this chapter gives a comparison of frs 102 section 18 and ifrs, and covers recognition and initial measurement,. Web under frs 10, software costs which met the definition criteria of an asset were capitalised exclusively as a tangible rather than. Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for. Software Costs Frs 102.

From www.slideshare.net

FRS102LimitedExampleFinancialStatements Software Costs Frs 102 Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap. Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for migration and testing. Web under old gaap, website development costs were classed as property, plant and equipment whereas under frs 102. Under. Software Costs Frs 102.

From www.slideserve.com

PPT IFRS and UK GAAP Update PowerPoint Presentation ID1680809 Software Costs Frs 102 Under frs 102 website development costs are usually considered in the context of intangible assets. Web apart from software and hardware costs, the company incurred costs to design the platform (£10,000) and costs for migration and testing. Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap. Web under old gaap,. Software Costs Frs 102.

From focusandsomaraccountants.com

FRS 102, FRS 102 1A and FRS 105 Focus Audit & Tax Accountants LLP Software Costs Frs 102 Web software companies in tech using frs 102 must prepare, as revenue recognition aligns with ifrs and us gaap. Web under frs 10, software costs which met the definition criteria of an asset were capitalised exclusively as a tangible rather than. Under frs 102 website development costs are usually considered in the context of intangible assets. Web under frs 102,. Software Costs Frs 102.